Investing a New Way

Smart Money Investing?

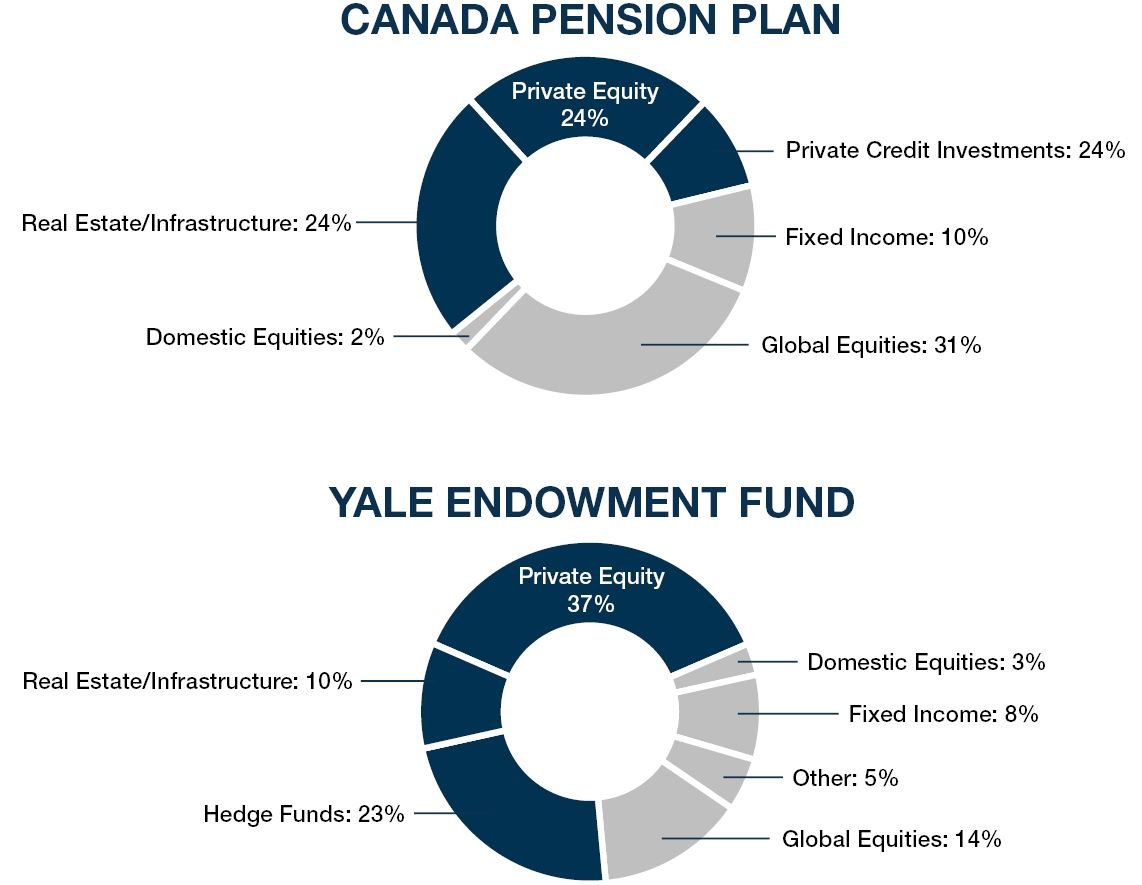

Sophisticated investors are turning to Alternative Investments due to low bond yields, central bank intervention, and overvalued stocks. Alternative Investments offer higher potential returns and protection against downside risks.

Composition

Traditional 60%/40% Portfolio is no longer effective due to volatile equity markets, rising interest rates, and low bond returns. A new approach is needed.

The New Pension Fund Style 60%/40% Portfolio suggests an asset mix of 40% Tactically Managed Equities and 60% Alternatives, offering better potential returns.

Benefits of this approach include diversification, low correlation with equity markets, reduced drawdowns, improved risk-adjusted returns, and investor satisfaction.

Private Credit

Private credit offers investors senior secured positions in the capital stack, providing equity-like returns without volatility. It is increasingly favored for diversification.

Institutional investors in Canada, such as CPPIB, PSP, and Ontario Teacher's, have increased allocations to private debt in their portfolios.

Private credit pools provide different risk/reward profiles attractive to investors compared to traditional fixed income options.

Private Real Estate

Private real estate investments involve income-generating properties and offer benefits such as capital growth, stable cash flows, and access to select real estate opportunities. Institutional investors have been investing in private real estate for decades due to its defensive nature and attractive long-term returns.

Private real estate can diversify the overall risk-return profile of an investment portfolio and can be a complement to publicly traded securities in different portfolios, ranging from income-oriented to growth-oriented.

Historically, retail investors have had limited exposure to private investments due to factors such as accredited investor requirements and high investment minimums.

Why Private Equity?

Private equity investments have consistently outperformed public markets due to their resilience during market downturns.

The COVID-19 pandemic has created investment opportunities in private equity not seen in a decade.

Companies are staying private longer, leading to exponential growth and higher valuations for early investors.

Institutional investors are increasing their exposure to private equity due to its superior returns and reduced volatility.

Private equity has become the largest alternative asset class globally.

Overall, alternative investments like private debt, private equity and private real estate offer investors the potential for higher returns and diversification compared to traditional options. Institutional investors are increasingly embracing these alternatives in their portfolios.

DISCLAIMER: Always talk to a professional before investing to know if the product is right for you. Past performance does not necessarily predict future results, each asset class has its own risks.